Climate Change (TCFD)

- Home

- Sustainability

- Environment

- Climate Change (TCFD)

Responding to Climate Change

Disclosure Based on TCFD Recommendations

In February 2022, we announced our support for the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). In addition to enhancing governance, we are striving to improve both the quality and quantity of disclosure and integrate strategies for the transition to decarbonization by analyzing the risks and opportunities related to climate change for Group businesses.

Governance

We have developed a governance structure, centered on oversight by the Board of Directors and management by the Sustainability Promotion Committee, to promote basic policies and priority topics related to the environment, including climate change, in accordance with our Environmental Policy and Action Guidelines.

Climate Change Management Structure

Chaired by the director in charge of sustainability, the Sustainability Promotion Committee’s membership consists of Group company CEOs and other executives. The committee meets twice a year to discuss risks and opportunities related to climate change and reports its findings to the Board of Directors, which oversees related activities.

Executive Compensation Linked to the Achievement of Environmental Indicators

In light of the importance of climate change and other global environmental issues, the Group has established a compensation system in which compensation for the chairman and representative director is linked to a rating score based on the ESG evaluations of the Group provided by various external rating agencies, including their assessments of climate change–related initiatives. This framework promotes the achievement of nonfinancial KPIs across the organization, with the chief executive officer actively monitoring progress on measures to implement renewable energy deployment strategies and to achieve climate change targets.

Strategies

Scenario Analysis

In implementing scenario analysis, the Sustainability Promotion Committee identifies major risks and opportunities related to climate change and assesses specific monetary amounts of their financial impacts. The committee formulated two scenarios to consider impacts in 2030 centered on two businesses it deems especially susceptible to climate change: Special Needs Employment Services (S-Pool Plus, Inc.) and Logistics Outsourcing Services (S-Pool Logistics, Inc.). These scenarios assume either success in achieving carbon neutrality by 2050 or increasingly severe global warming.

-

1.5℃ scenarioScenario under which global decarbonization initiatives achieve carbon neutrality by 2050, including associated changes in regulations and market trendsScenarios referenced:

IEA WEO-2021*1 – SDS*2 / APS*3 /

NZE2050*4, IPCC AR5*5 - RCP*62.6 -

4℃ scenarioScenario under which global warming grows more severe due to a lack of progress on decarbonization, leading to increasingly severe weather events, damage caused by such weather events, and the growing need to adapt to such changesScenarios referenced:

IEA WEO-2021*1 – STEPS*7 /

IPCC AR5*5 – RCP*68.5

*1 World Energy Outlook 2021 of the International Energy Agency

*2 Sustainable Development Scenario

*3 Announced Pledges Scenario

*4 Net Zero Emissions by 2050 Scenario

*5 Fifth Assessment Report of The Intergovernmental Panel on Climate Change

*6 Representative Concentration Pathway

*7 Stated Policies Scenario

Business Impact Assessment

Based on the scenario analysis, we qualitatively analyzed the financial impacts on our businesses and, for items for which estimation was possible, performed calculations using mathematical models. We then evaluated the impact on revenues expected in 2030 by item. Identified risks and opportunities are shown in the following table.

| Item | Impact | Evaluation ※1 | |||||

|---|---|---|---|---|---|---|---|

| Category | Subcategory | Sub-subcategory | Time axis ※2 | Indictor | Considerations | 4℃ | 1.5℃ |

| Migration risks | Policy/regulatory | Carbon pricing | Medium term | Expenditures |

[Groupwide]

Rising costs related to electricity, fuel

use, etc. at logistics facilities, farms,

and other business sites due to carbon

pricing

|

Low | Medium |

| Responding to GHG emissions restrictions |

Medium term - long term |

Expenditures Assets |

[Groupwide]

Rising costs associated with measures to

improve the environmental performance of

logistics facilities, farms, and other

facilities to meet more rigorous GHG

reduction requirements

|

Low | High | ||

| Plastic restrictions | Medium term | Expenditures |

[S-Pool Logistics, Inc.]

Cost of responding to regulations governing

use of plastic and other packing materials

|

Low | Medium | ||

| Markets | Changing energy costs |

Short term - Medium term |

Expenditures |

[Groupwide]

Higher selling expenses due to the rising

cost of the fuel used in temperature

controls

|

Medium | Medium | |

| Changing customer behavior |

Short term - Medium term |

Revenues |

[Groupwide]

As environmental awareness grows among

clients, risk of declining revenue due to

inability to shift to services and products

with lower environmental impact

|

Low | High | ||

| Reputation | Changing reputation among investors |

Medium term - long term |

Revenues Expenditures |

[Groupwide]

Falling stock prices or rising fundraising

costs if investors determine our initiatives

are inadequate based on their growing

interest in environmental initiatives

|

Medium | High | |

| Physical risks | Acute | Intensifying abnormal weather events |

Short term - long term |

Revenues Expenditures Assets |

[Groupwide]

Weather-related damage leading to the

suspension of operations at farms, logistics

facilities, etc.; reduced earnings due to

suspended operations at client facilities

|

High | Medium |

| Chronic | Worsening working and construction conditions |

Short term - long term |

Revenues Expenditures |

[S-Pool Plus, Inc.]

Lower productivity or higher hiring costs

due to fewer applicants as rising

temperatures lead to worsening working

environments inside greenhouses

|

High | Medium | |

| Opportunities | Energy source | Use of renewable energy |

Short term - Medium term |

Revenues |

[S-Pool Logistics, Inc.]

Sales growth achieved by providing

differentiated services using renewable

energy

|

Low | Medium |

| Products/Services | Decarbonization services |

Short term - Medium term |

Revenues |

[S-Pool Logistics, Inc.]

Sales growth achieved by using non-plastic

packing materials in response to growing

demand for ethical consumption

|

Low | Medium | |

| Disclosure |

Short term - Medium term |

Revenues |

[S-Pool Blue Dot Green Inc. / S-Pool,

Inc.]

Greater demand for disclosure consulting

services to meet corporate disclosure

obligations

|

Low | High | ||

| Market | emissions trading |

Short term - Medium term |

Revenues |

[S-Pool Blue Dot Green Inc. / S-Pool,

Inc.]

Sales growth for emissions trading brokerage

services

|

Low | High | |

| Resilience | Adapting abnormal weather events |

Short term - Medium term |

Revenues |

[S-Pool Plus, Inc.]

Providing services in urban areas based on

indoor farms, which are less susceptible to

climate change risks

|

Medium | Low | |

※1 Time horizon: Short-term = 1 to 3 years

Medium-term = 3 to 10 years Long-term = 10 years and

up

※2 Financial Impact Assessment: Large=More than 100

million yen, Medium=Less than 100 million yen,

Small=Minor or no impact

Migration risks: Risks generated from reassessment

of the financial value of assets with high levels of

GHG emissions, accompanied with migration to

low-carbon economy

Physical risks: Direct impact such as property

damage caused by flooding, heavy wind and rain, and

other weather conditions; indirect impact such as

global supply chain disruptions and resource

depletion

Thinking of financial impact (small, medium, large):

Relative impacts assessed through quantitative and

qualitative analysis

4℃ scenario: A scenario under which global

mean temperatures by the end of this century are

about 4℃ higher than before the industrial

revolution due to the lack of progress on measures

to counter climate change. While this scenario poses

high physical risks, including intensification of

abnormal weather events and rising sea levels, it

also assumes no additional restrictions on corporate

and consumer behavior from current levels.

1.5℃ scenario: A scenario under which global

mean temperatures by the end of this century are

about 1.5℃ higher than before the industrial

revolution due to active initiatives toward

achieving carbon neutrality. While this scenario

envisions a controlled increase in physical risks,

it also assumes stronger restrictions on corporate

and consumer behavior through means such as taxation

policies, laws, and regulations.

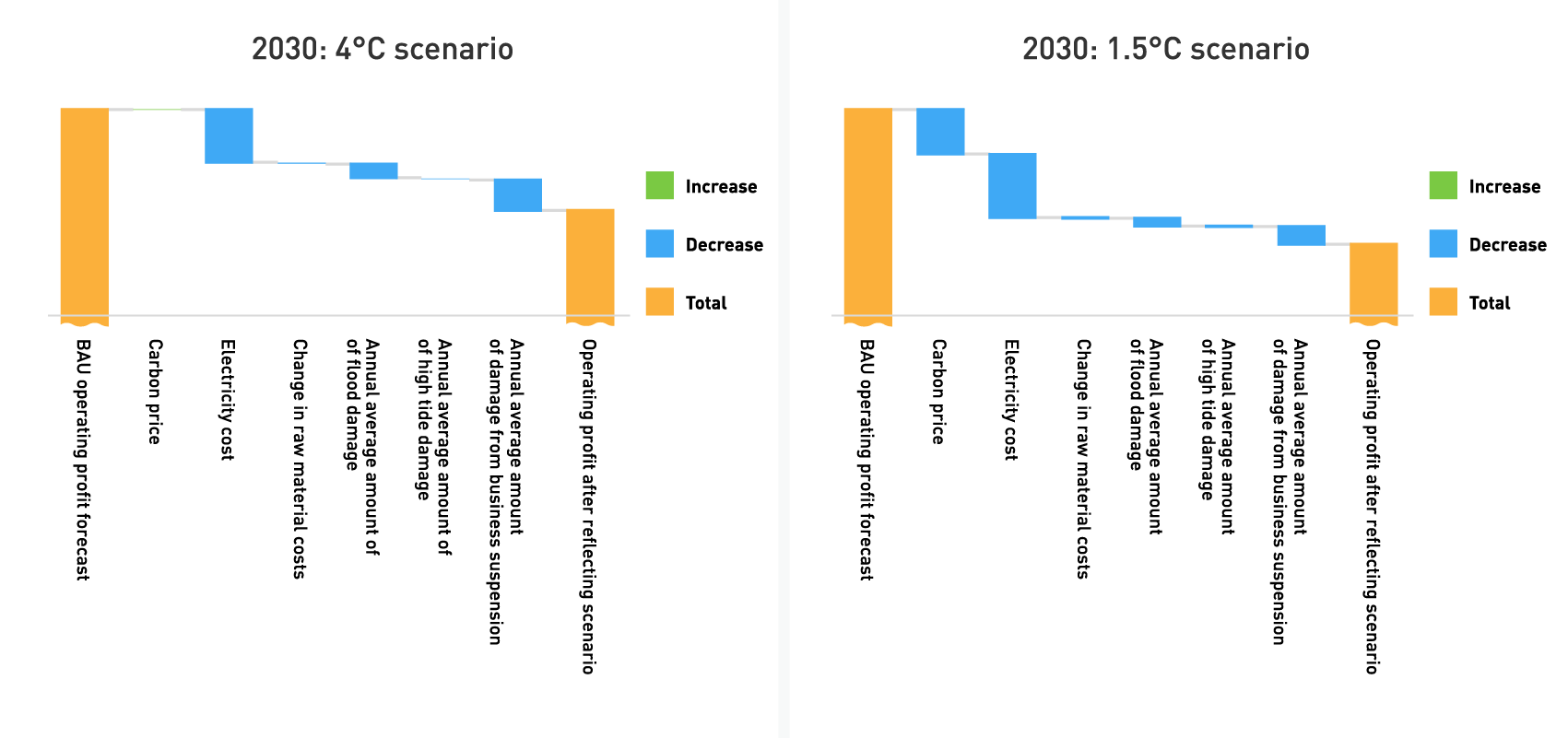

In assessing the scale of impacts through use of quantitative business impact estimates, we regard a financial impact of ¥100 million or more as high. Qualitative impacts assume the same definition. The risks estimated are shown below. For physical risks (extent of damage due to flooding or high tides, extent of damage due to suspended operations), we averaged annual expected damages based on the relative evaluation by taking into account the probability of the disasters occurring.

As Groupwide impacts, physical risks include damage from natural

disasters such as flooding and other water-related hazards.

In particular, in the event of a disaster, business suspensions

at farms or logistics centers could occur, potentially resulting

in losses that would put pressure on finances. With respect to

transition impacts associated with decarbonization, additional

expenditures may be required due to the introduction of carbon

pricing schemes, while rising energy costs are also a concern.

Electricity, which is the Group’s primary energy source, is

expected to drive higher expenditures due to increased use of

air conditioning as temperatures rise and higher electricity

prices associated with the transition to renewable energy.

On the other hand, as decarbonization progresses, various

measures are being considered across industry and government

agencies. These developments are expected to lead to expanded

application of administrative services and greater corporate

information disclosure. Against this backdrop, demand is

anticipated to increase for the Group’s decarbonization support

services for local governments as well as for the environmental

management support services offered by S-Pool Blue Dot Green.

Impacts identified for each business are as follows.

-

Special Needs Employment Services

Under the 4℃ scenario, this business is expected to face chronic impacts primarily in farm operations, such as a deterioration of working conditions due to increased risk of heatstroke caused by rising temperatures, and difficulties in temperature control for crop cultivation, which could result in operational suspensions.

In contrast, under the 1.5℃ scenario, while operating costs are expected to increase due to the establishment of tax systems aimed at decarbonization and rising energy prices, we have identified opportunities for revenue growth and enhanced corporate value through the development of services that respond to changes in customer behavior and shifting perceptions regarding reputation. -

Logistics Outsourcing Services

Under the 4℃ scenario, we reconfirm that this business faces high physical risks, including operational suspensions, countermeasure costs, and significant damage in the event of disasters caused by intensifying extreme weather, such as damage to our logistics warehouses or destruction of infrastructure. However, even under this scenario, we have identified potential for social contribution through changes in customer behavior, such as expanded use of e-commerce, as well as organizational reinforcement, including strengthened business continuity planning (BCP).

In contrast, under the 1.5℃ scenario, while operating costs are expected to increase due to carbon pricing introduced as part of the transition to decarbonization, we have identified opportunities to enhance corporate value through improvements in the environmental performance of packaging materials and equipment.

The results of these analyses and deliberations will be enhanced resilience for future uncertainties by incorporating the results of deliberations in management strategies.

Specific Strategies and Initiatives

Based on the risks and opportunities identified in the scenario analysis above, the Group has begun to integrate the following strategies.

-

Our response to transition risks, such as carbon pricing systems, is to promote Groupwide decarbonization. Since the fiscal year ended November 2023, our head office has been switching to renewable energy programs and purchasing non-fossil fuel certificates. As a result, in the fiscal year ending November 2024, approximately 9% of the electricity we used was derived from renewable energy sources.

Our response to transition risks, such as carbon pricing systems, is to promote Groupwide decarbonization. Since the fiscal year ended November 2023, our head office has been switching to renewable energy programs and purchasing non-fossil fuel certificates. As a result, in the fiscal year ending November 2024, approximately 9% of the electricity we used was derived from renewable energy sources.

To capture opportunities, in addition to our traditional services for corporate clients, we began providing decarbonization transition support services for municipal authorities in the fiscal year ended November 2023. These services support the promotion of zero-carbon cities by enabling municipalities to calculate and reduce their GHG emissions. In the fiscal year ending November 2024, we concluded new comprehensive cooperation agreements with six municipal authorities aimed at realizing zero-carbon cities, bringing the total number of such agreements to 18 nationwide. -

As for physical risks, we envision wind and water damage such as flooding. The physical impact on the farms of S-Pool Plus is of particular concern. Therefore, we have been establishing indoor farming facilities that use less water and are less susceptible to the impact of disasters. For example, in fiscal 2019 we formulated indoor farm selection criteria that take into account areas prone to flooding in the event of torrential rain or river overflows. In fiscal 2024, three of the seven farms we opened were indoor farms. As with indoor farms, when selecting locations for outdoor farms, we are mindful of which areas are prone to flooding in the event of torrential rain or river overflows. The criteria enhance the resilience of our farms to wind and water damage and ensure the safety of farm workers.

As for physical risks, we envision wind and water damage such as flooding. The physical impact on the farms of S-Pool Plus is of particular concern. Therefore, we have been establishing indoor farming facilities that use less water and are less susceptible to the impact of disasters. For example, in fiscal 2019 we formulated indoor farm selection criteria that take into account areas prone to flooding in the event of torrential rain or river overflows. In fiscal 2024, three of the seven farms we opened were indoor farms. As with indoor farms, when selecting locations for outdoor farms, we are mindful of which areas are prone to flooding in the event of torrential rain or river overflows. The criteria enhance the resilience of our farms to wind and water damage and ensure the safety of farm workers. -

As a climate change mitigation measure, we are promoting environmental management aimed at achieving net zero CO₂ emissions. As part of our voluntary environmental initiatives, we have participated in the “RE Action—Declaration of 100% Renewable Energy” since 2020, and in 2023 we began introducing renewable energy at major sites through the use of FIT non-fossil fuel certificates. In addition to gradually switching to renewable energy, we are also pursuing automation to reduce labor needs, thereby working to lower CO₂ emissions.

As a climate change mitigation measure, we are promoting environmental management aimed at achieving net zero CO₂ emissions. As part of our voluntary environmental initiatives, we have participated in the “RE Action—Declaration of 100% Renewable Energy” since 2020, and in 2023 we began introducing renewable energy at major sites through the use of FIT non-fossil fuel certificates. In addition to gradually switching to renewable energy, we are also pursuing automation to reduce labor needs, thereby working to lower CO₂ emissions.

Furthermore, as a new initiative toward realizing carbon neutrality, we plan to establish zero-emission warehouses designed to minimize environmental impact, with the goal of achieving zero CO₂ emissions. At the same time, we are making forward-looking investments in anticipation of advances in automation technologies to build a sustainable operational framework. In the event that logistics are disrupted by natural disasters, we will prioritize employee safety and cargo protection while minimizing impact through the prompt sharing of delivery status.

We pursue the following initiatives to reduce greenhouse gas emissions and energy consumption and to improve efficiency.

| Category | Initiatives |

|---|---|

| Mitigation |

[All companies]

[S-Pool, Inc.]

|

| Adaptation |

|

Risk Management Process

The Sustainability Promotion Committee identifies and assesses significant climate change-related risks and opportunities. In doing so, the committee uses the scenario analysis described in Strategies, 1. Scenario Analysis on page 48 to collect and analyze information on social conditions and the market environment, which enables early detection of significant issues related to businesses, identification of comprehensive risks, and qualitative and quantitative assessment of the scale of financial impact. Finally, along with the results of this assessment, the likelihood of occurrence and the timing of actualization are taken into consideration to select the issues that most urgently require countermeasures. An order of priority is then established for these issues. All the selected priority issues identified as risks are entrusted to the Risk Management Committee, which integrates them into a Groupwide risk management process. This committee, which meets semiannually, conducts comprehensive risk assessments that include climate change-related risks. Based on these assessments, the committee considers measures to prevent the actualization and mitigate the impact of risks with potentially significant impacts and collaborates with the Sustainability Promotion Committee as necessary. Similarly, priority issues identified as opportunities are placed under the management of the Sustainability Promotion Committee, which considers measures to be taken. In both cases, under the supervision of the Board of Directors measures are considered and then deployed to the relevant business sections and subsidiary sections.

Indicators and Targets

The GHG emissions reduction target for the S-Pool Group as a

whole calls for a 40% reduction by 2030 in Scope 1 and Scope 2

emissions compared to the base year of fiscal 2021.We also

plan to achieve carbon neutrality Scope 1 and Scope 2 emissions

by 2050.

* In light of domestic and international trends, the

base year has been revised to the fiscal period ended

November 2021. Reduction targets have been revised

upward.

* The scope of targets is identical to the scope of

calculations of greenhouse gas emissions provided

below.

To achieve these targets, we are carrying out practical efforts to achieve use of 100% renewable energy in Group business activities by 2030.Please refer to our ESG data page for actual results and progress on targets for each indicator.

Participation and support of industry organizations, initiatives, etc.

The S-Pool Group participates in and supports the following industry organizations and initiatives to promote initiatives to address climate change.

In March 2022, we announced our support for the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). Future plans call for continuing to incorporate initiatives to address climate change in our business strategies and disclosing information based on TCFD recommendations.

In February 2021, we participated in the Japan Climate Initiative. Through this initiative, we will proactively work to achieve a low-carbon society.

S-Pool Logistics is a participant in RE Action – Declaring 100% Renewable, declaring its intent and taking actions to convert to 100% electricity from renewable energy sources.

We review our participation in and support for industry associations regularly for any major conflicts in thinking between the industry associations and the Company, with consideration for consistency with our business objectives, priority areas, and business activities. We consider withdrawal of our participation and support if any major deviations have been identified.